Understanding the Growing Strains on the Grid

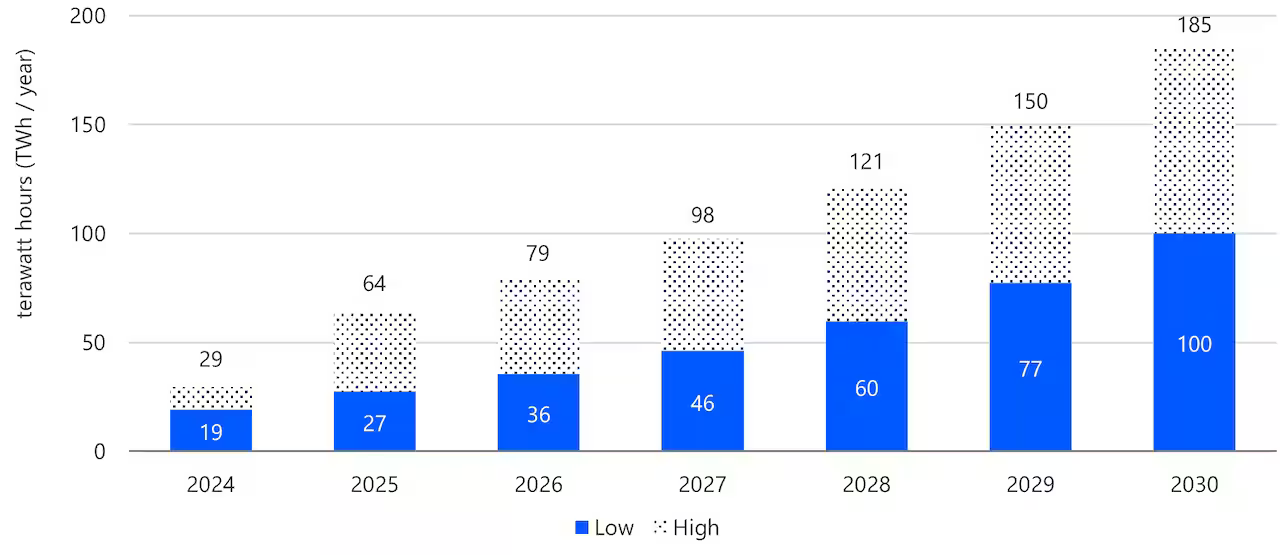

The ongoing adoption of electric vehicles (EVs) has gradually and significantly impacted the power grid’s resilience worldwide. By 2030, electric vehicles’ electricity demands in the US alone could reach between 2.5% and 4.6% of the total power demand. Worldwide, the overall surge in electricity demand could reach 20%. The energy consumed by data centers is predicted to reach 10% of the total available power during the same period.

The threat to a continuously resilient grid stemming from these two sources presents different challenges and requires different solutions. Power demand from electric vehicles is widely distributed as vehicles tend to drive. Data centers are static, and their energy consumption strains the local grid.

How Electric Vehicle Adoption Impacts Distributed Resilient Grid

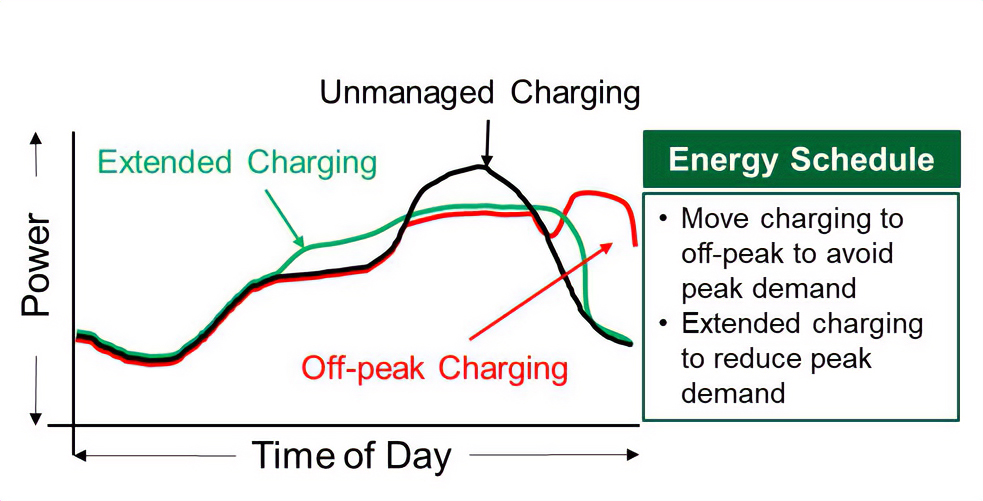

When a large number of electric vehicles plug in to charge at the same time, the distributed load it creates affects the overall electric grid resilience. As their charging time is entirely dependent on drivers’ habits, it leads to peak residential electricity demand. This peak-time spike can overload transmission grids and create voltage instability, which threatens the electric grid’s resilience and risks leading to more brownouts and blackouts.

Source: BNEF, National Renewable Energy Laboratory (NREL), RaboResearch 2024

To address, or at least mitigate such disastrous effects, the June 2024 Congressional Report on the Impact of Electric Vehicles on the Grid suggests incentives to flatten the consumption peak. They explore various programs, such as managed charging strategies, timed charging, load modulation, and time-of-use rates, that would incentivize users to adopt behaviors or take part in alternate programs designed to spread charging time across more hours. However, even their most optimistic projection shows that the peak remains, even if flattened a bit.

Source: Impact of Electric Vehicles on the Grid, Report to Congress, June 2024

The implementation and adoption of such programs will vary from place to place, so ensuring a reliable power supply to all customers will remain largely dependent on the grid’s ability to adjust to variable distributed demand peaks. And the grid must be ready for that.

However, standard operating procedures for assessing distribution grid impacts based on maximum operating conditions can overstate electric vehicles’ energy requirements, leading to longer review processes and more expensive upgrades. Increased transparency about available capacity, Dynamic Line Rating, and other real-time transmission grid adjustment capacity solutions can reduce infrastructure upgrades and costs.

How Data Centers’ Gigawatt Energy Hubs Affect Localized Grid Resilience

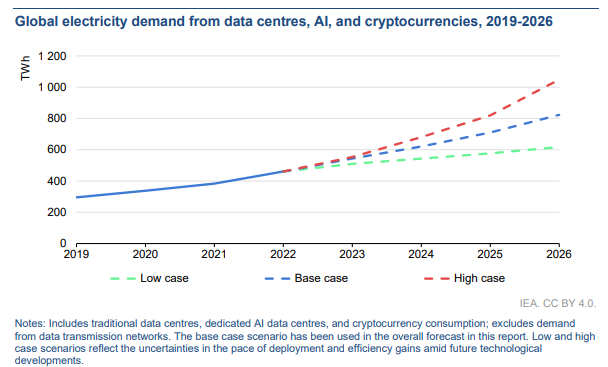

In contrast to the distributed nature of EV charging, data centers’ demand for electricity is highly localized and concentrated. Driven by reliance on cloud services, data sprawl, AI power-intensive workloads, and cryptomining, the global data center electricity usage is projected to double by 2026. The annual electricity report from the International Energy Agency (IEA) states that data centers consumed 460 TWh in 2022, a figure that could rise to more than 1,000 TWh by 2026 in a worst-case scenario.

Source: Electricity 2024 Analysis and forecast to 2024

Compute power and cooling are the two most energy-intensive processes within data centers, and the rapid growth of artificial intelligence-related services means providers consistently invest in power-hungry GPUs.

In Ireland, the situation is especially acute, as a high number of new builds planned could lead to data center electricity consumption reaching 32% of all power consumption by 2026, a massive increase from 17% in 2022. Yet, calls to curtail data center construction have been ignored.

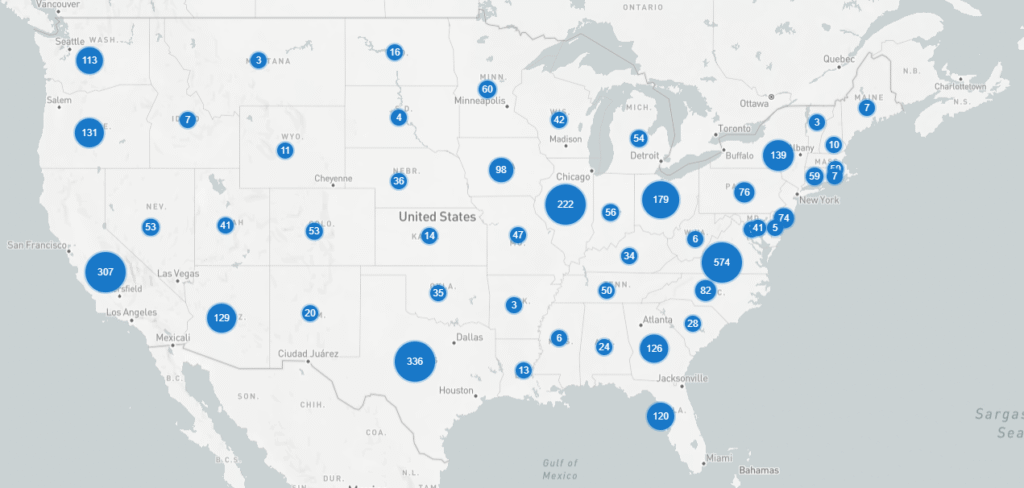

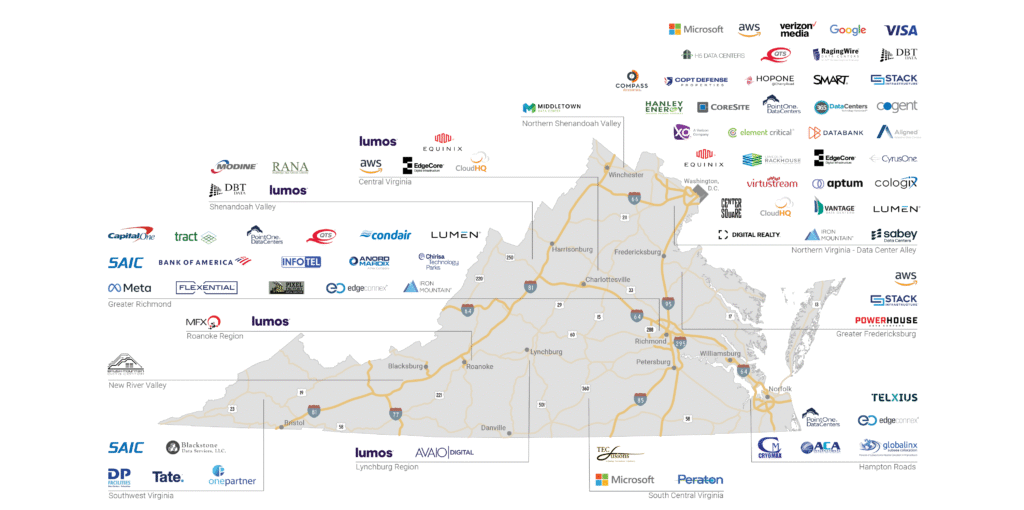

In the U.S., data center owners prefer areas with abundant electricity, copious amounts of water for cooling, access to fiber connectivity, affordable real estate, and tax incentives and away from regions prone to natural disasters. Their primary locations are in Northern Virginia, Dallas, Silicon Valley, Phoenix, Chicago, Atlanta, Portland, the New York/New Jersey area, Seattle, and Los Angeles.

In Virginia, the combination of power costs about 28% lower than the national average, wide availability of optic fibers, a tax exemption policy since 2009 long before other States followed their example, competent workforce ability, and low natural disaster rates led to a unique concentration of data centers.

The investment in data centers in the US is steadily growing and shows no signs of slowing down.

In 2023, the overall capital investment by industry leaders in AI adoption and data center installation, Google, Microsoft, and Amazon, was higher than that of the entire US oil and gas industry and totaled around 0.5% of US GDP.

The issues with data centers, especially when clustered in localized hubs, are not limited to their massive power requirements. Expecting even a local resilient grid to meet these requirements is a risky bet. Aware of this strain on the grid resilience and the associated risks to their operations, the Big 4 (Alphabet, Microsoft, Meta, and Amazon) are acquiring power production plants near their data centers to ensure independent supply.

That will help relieve the strain on the aging grid, which is already struggling to meet demand, but it is unlikely to be sufficient to ensure a stable supply. Even then, generating and delivering enough power to meet the demand is not enough. There are other ways data centers threaten the electric grid’s resilience.

The data center industry is highly dependent on computer chips and electronic equipment, and those are susceptible to damage caused by voltage fluctuations.

Data centers rely on uninterruptible power supply (UPS) systems to instantaneously take over providing power to the data center equipment when a grid disturbance occurs. These safety mechanisms have a hair-trigger reaction time to voltage variation. In July 2024, in Northern Virginia, a millisecond voltage variation due to a faulty lightning arrestor caused multiple data centers to drop off the grid and switch their UPS systems.

Sixty data centers, using 1,500MW of power, dropped off the grid simultaneously. The grid is not built to handle such a massive and abrupt drop in power consumption, and this event forced the network operators to take drastic action to avoid widespread blackouts.

The Intersection of Distributed and Localized Demand

Electric vehicle adoption and data center growth have potentially conflicting priorities and investment strategies for grid management.

The distribution of electric vehicles’ power demand spread out across numerous local levels requires widespread upgrades to local substations and transformers to avoid overloaded transmission grids and voltage instability during peak charging hours.

Data Centers’ high-density power consumption in specific geographical areas, on the other hand, requires significant upgrades to the high-voltage transmission infrastructure. Delivering large amounts of power to a concentrated area may necessitate reinforcing existing transmission lines or building new high-capacity corridors.

Overlapping stress points in cities experiencing both rapid electric vehicle adoption and new data center clusters can strain the grid in multiple ways simultaneously. This increased strain elevates the risk of cascading failures.

Strategic Grid Resilience Investments

The fastest and most economical way to address these challenges is to avoid the cost of grid inefficiency.

Continuous monitoring of grid conditions and accurate forecasting of both distributed and localized demand is essential for anticipating potential stress points. The construction of new transmission infrastructure is a slow and expensive project, and the modernization of energy systems needs to accelerate. In the near term, grid-enhancing technologies (GETs) provide a valuable opportunity to increase the efficiency and capacity of the existing power grid at a lower cost to consumers.

Optimizing Grid Capacity: The Prisma Photonics Approach

Meeting the dual challenge of supporting distributed electric vehicle charging and high-density data center demand requires a smarter use of the existing grid.

-

Leveraging Existing Infrastructure

Instead of costly new builds, Prisma Photonics uses existing OPGW optical fiber to monitor transmission line state in real-time and with precise location of any issue, maximizing ROI on legacy assets.

-

Real-Time Grid Visibility

Prisma Photonics’ continuous, high-resolution fiber-optic sensing provides deep visibility into grid stress, sag, or hotspots in real time, with ample time to prevent failure.

-

Creating More Capacity with DLR

By enabling accurate wind measurement on every power line span, Prisma Photonics offers extensive Dynamic Line Rating, allowing the increase of line capacity in a safe, risk-aware manner – always making sure to keep the assets’ safe margins.

-

Predictive Insights for Load Management

AI-driven analytics forecast congestion patterns and dynamically adjust load flow, balancing demand and preventing brownouts and blackouts.

-

Enhanced Classification

Advanced signal processing improves event classification across vast transmission networks, allowing grid operators to distinguish between harmless disturbances and issues requiring intervention.

-

Preventing Failures and Downtime

Predictive maintenance based on actual grid conditions reduces unplanned outages and extends equipment lifespan. Grid-enhancing technologies are now a prerequisite for resilience. Prisma Photonics helps build a smarter, stronger grid that can keep pace with the rising demands of electric vehicles and data centers.